- Amidst Uncertainties, Two-Thirds of Americans are Considering a Financial Resolution

- Gen Z-ers, Millennials More Likely to Consider Money Resolutions, More Optimistic About 2023

- Fidelity Shares Resources and Insights to Help Make and Keep Financial Resolutions

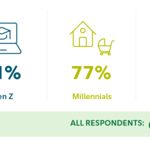

BOSTON–(BUSINESS WIRE)–As the country prepares to ring in the new year, Americans are feeling less-than-optimistic when it comes to the year ahead, according to Fidelity Investments®’ 2023 New Year’s Financial Resolutions Study. In a dramatic shift from last year’s results, more than a third of respondents say they’re in a worse financial situation than last year, likely due to inflation concerns, and only 65% believe they’ll be better off in the coming year (vs. 72% in the last study). The good news? About half say they’re ready to “live sensibly” or “plan ahead,” which means making practical resolutions and staying focused on balancing short-term and long-term financial goals. And, the next generation1 continues to serve as a beacon of hope, with more than three-quarters expressing confidence they will be better off financially in 2023.

“After the stresses of the last few years, Americans are understandably taking a pragmatic view of their financial situation,” said Stacey Watson, senior vice president of Life Event Planning, Fidelity Investments. “This is an encouraging indication of the grit and resilience we can tap into when the financial going gets tough. Given the ups and downs experienced, being creative and establishing new financial wellness habits are positive signs many are finding ways to shift the focus, to pay down debt or build up emergency savings. Proper planning, and balance, are key.”

Due to concerns about the state of the world and global economy, three quarters of Americans would rather proceed with caution; for those in worse financial shape than last year, more than half (58%) attribute this to inflation. Despite these headwinds, two-thirds (66%) of respondents are considering a financial resolution for 2023, which is at a similar level as last year (68%); 80% of next generation respondents plan to make financial resolutions.

State of Resolutions: Optimism May Have Dimmed, but Resilience Remains

Of those planning a financial resolution for the new year, 94% say they’re approaching it differently given events of the last couple years, focusing on the practical even more than in the past—and nearly half (45%) are considering more conservative goals for the year ahead. Despite this new mindset, the top resolutions remain consistent with past years: save more money (39%), pay down debt (32%), and spend less money (28%). Notably, for the first time in the study’s 14-year history, more Americans plan to save money for short-term goals rather than long-term goals as part of their New Year’s resolution. Next generation savers are evenly split, with 50% saving for the short-term and 50% looking longer. A recent Fidelity study suggests many women are already making proactive short-term money shifts, with 53% cutting back on non-essential activities and entertainment and 41% reducing recurring expenses.

The Impact of Inflation

The record-high inflation of the last year has made its presence known in Americans’ wallets and their minds. Inflation was cited as the top financial setback experienced in 2022, and its impact is expected to continue; respondents ranked it their top financial concern for 2023.

Among those experiencing a financial setback in the past year, 44% had to dip into their emergency fund. Given this, there’s little surprise to find more Americans are in a worse financial situation than last year. Baby Boomers led the way, possibly in part due to declining retirement balances, with more than 4 out of 10 (43%) saying they and their family are in worse shape:

Positive Practices Prevail in a Season of Living Sensibly

While 2022 presented challenges, the study also reveals encouraging news: more people express having a positive relationship with money than negative. And among those making financial resolutions, the top motivations remained consistent year-over-year: achieving “greater peace of mind” and “living a debt-free life.”

When asked to describe their expectations for 2023, 29% described their outlook as ‘the year of living sensibly.’ Encouragingly, nearly half (49%) expect to maintain the savings habits they’ve picked up during the pandemic. Some of the top things Americans are trying to do for themselves in 2023 include taking the time to exercise more, spending time with those they love, worrying less, and focusing on things that truly matter. Of note, a greater number of next generation respondents (56%) plan to get more involved in charitable giving in 2023 than other generations.

“Even if the focus for now is understandably on more immediate needs, our long-term goals and objectives are what keep us going—and planning can help,” said Watson. “Taking charge of your financial situation is a great way to help you feel a sense of control, even when external forces bring challenges. If you are able to, saving more and paying down debt, even small amounts, can have a tremendous impact on the financial and emotional well-being of a household—and Fidelity has resources that can help you improve your financial wellness.”

Making Resolutions – and Sticking with Them, Too

With so many headwinds, how can Americans tap into their resolve to build a stronger financial future in the new year? To start, those in better financial shape this year reported saving more, budgeting better, and/or working more hours. And when it comes to keeping resolutions, those who successfully kept their 2022 resolutions shared powerful insights:

Ultimately, more than eight-in-10 Americans say having a plan in place can help them better deal with the unexpected. Making resolutions is a great way to start the year off on the right foot—and it’s been shown this simple act may have a positive impact on your attitude and your finances.

To Help Plan and Set Achievable Financial Resolutions, Help Is Just a Click Away

- Fidelity’s Life Events hub is an online resource created to help people, whether someone is a Fidelity customer or not, plan for and manage life’s most significant moments. This includes a robust library of checklists and other tools for more than three dozen different situations, including managing a job change, caring for aging loved ones, experiencing divorce, and navigating the college journey.

- No matter what you’re focused on – building emergency savings, paying down debt, managing spending, saving for retirement, etc. – Fidelity can help you create a free, flexible plan to make progress towards what matters most to you: www.fidelity.com/freeplan.

- In January during Financial Wellness month, Fidelity offers 31-days of educational events, daily financial tips, interactive tools, and a broad range of solutions to inspire people to kick off the new year with a renewed focus on their finances.

- With a commitment to the next generation of investors, Fidelity understands it can be intimidating not knowing how to get started. There’s plenty of free resources, digital tools, newsletters and educational content that breaks down the basics, including managing your money, investing, and planning for retirement.

- The Fidelity Bloom® app is another great resource, as the free2 financial app and debit card can help you save more, spend less, and feel better about your finances by using behavioral science with built-in features that help you grow your savings and change your money habits.

- Tips to help keep financial resolutions going strong throughout the year can be found in these Fidelity Viewpoints articles: The Power of Having Savings Goals; 6 tips to keep your New Year’s resolutions

- Make that dream goal a reality with Fidelity Goal Booster, a digital experience designed to make it easier to set and save for short-term financial goals.

- At Fidelity you can take advantage of a 1:1 consultation to create a plan for your full financial picture that can help you grow and protect your wealth. Start a conversation.

- In addition, Fidelity representatives are available at no cost to answer questions 24/7 at 1-800-FIDELITY, or online at Fidelity.com.

About Fidelity Investments’ 14th Annual New Year’s Financial Resolutions Study

This study presents the findings of a national online survey, consisting of 3,020 adults, 18 years of age and older. The generations are defined as: Baby Boomers (ages 58-76), Gen X (ages 42-57), Millennials (ages 26-41), and Gen Z (ages 18-25; although this generation has a wider range, we only surveyed adults for the purposes of this survey). Interviewing for this CARAVAN® Survey was conducted October 17-23, 2022 by Big Village, which is not affiliated with Fidelity Investments. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study. Go here for more information on Fidelity’s 2022 New Year’s Financial Resolutions Study; additionally, for the first time, Fidelity surveyed teens to understand what they’re thinking about money in the new year.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $9.6 trillion, including discretionary assets of $3.6 trillion as of September 30, 2022, we focus on meeting the unique needs of a diverse set of customers. Privately held for over 75 years, Fidelity employs more than 60,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/aboutfidelity/our-company.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

The Fidelity Bloom App is designed to help with your saving and spending behaviors through your Save and Spend accounts, which are brokerage accounts covered by SIPC insurance. They are not bank accounts and therefore are not covered by FDIC insurance.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

245 Summer Street, Boston, MA 02110

1063277.1.0

© 2022 FMR LLC. All rights reserved.

Follow us on Twitter @FidelityNews

Visit About Fidelity and our online newsroom

Subscribe to email alerts for news from Fidelity

1 “Next generation” for this study is defined as respondents ages 18-35.

2 The Fidelity Bloom® app is free to download. Fees associated with your account positions or transacting in your account apply. Accounts made available via the app may be subject to fees.

Contacts

Corporate Communications

(617) 563-5800

fidelitymediarelations@fmr.com

Ted Mitchell

401-292-3084

ted.mitchell@fmr.com