- Half of all tractor customer online inquiries received no personal response

- Kubota dealerships ranked highest in the 2026 study, followed by TYM, Mahindra, John Deere, and Yanmar

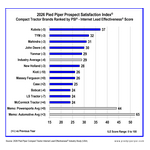

AUSTIN, Texas--(BUSINESS WIRE)--Kubota dealerships were ranked highest in the 2026 Pied Piper PSI® Internet Lead Effectiveness® (ILE®) Compact Tractor Industry Study, which measured dealership responsiveness to internet sales leads. Pied Piper submitted customer inquiries through 772 compact tractor dealership websites representing all major brands. Kubota dealerships achieved an average ILE score of 37 out of 100, while the total industry averaged 29, however both dropped five and four points respectively since the previous year’s study. Following Kubota in the rankings were TYM, Mahindra, John Deere, and Yanmar.

The study found that 47% of all tractor customer inquiries received no personal response, a rate 7% worse than last year. 2026 marks the fifth year that Pied Piper measured and reported compact tractor brand web-response performance, and these results show that industry average performance has not improved since 2022, while dealers in other motor vehicle industries have substantially raised their level of performance.

“The tractor industry has not improved in five years, and half of website customers receive no personal response,” said Cameron O’Hagan, Vice President of Metrics and Analytics at Pied Piper. “However, dealers receiving monthly web-response measurement and reporting dramatically outperform the industry, averaging an ILE score of 48, well above all compact tractor brands and also higher than the powersports industry average.”

How Was This Study Conducted?

Each of the 772 ILE evaluations completed for the study asked a specific question about a tractor in inventory, during normal business hours for each location, and provided a customer name, email address, and local telephone number. Pied Piper then evaluated the speed and quality of dealership responses sent by email, telephone, chat, and text message within the next 24 hours following each inquiry. ILE evaluation of a dealership consists of over 20 different weighted measurements, linked to best practices mathematically likely to generate sales. These measurements combine to create an overall ILE score ranging between zero and 100.

Industry Performance in Decline

The compact tractor industry’s average ILE score fell to 29, a four-point decline from last year. McCormick Tractor and Case were the only brands to show improvement, increasing four and two points respectively. All other brands were flat or declined by as much as seven points. Notably, even brands scoring above the industry average underperformed compared to dealers from other motor-vehicle industries.

The following are key behavior differences this year causing the drops in score:

- Less Personal Responses – Dealers industrywide were 7% less likely to phone the customer or answer their question by email/text, occurring only 53% of the time on average this year.

- More Crickets – Compared to last year, an additional 7% of customer inquiries submitted to dealer websites received no response, not even an automated response, occurring 27% of the time on average.

- Less Follow Through – Only 16% of the email responses received provided next steps for the customer or attempted to set an appointment, down 6% since last year.

What Behaviors Placed Kubota at the Top?

Kubota dealers in this year’s study had an average ILE score of 37, eight points higher than the industry average score. Kubota dealers answered the customer’s question more often on average, were more likely to use a combination of calls, texts, and emails when responding to customers, and had the lowest rate of failing to respond out of the brands measured.

- More Customer Questions Answered – Kubota dealers answered the customer’s question by email or text 49% of the time on average, the third highest rate among the brands and 7% more often than the industry average.

- Higher Rate of “Doing Both” – Kubota dealers were more likely to utilize multi-channel responses - answering the customer's question by email/text while also calling the customer – doing so 23% of the time, almost double the overall industry.

- Fewer Failures to Respond – Customers received no response only 16% of the time on average when contacting Kubota dealers, compared to 27% of the time industrywide.

2026 Brand Performance Compared:

-

“Answered Question” - How often did the brand’s dealerships email or text an answer to a website customer’s question?

- More than 50% of the time on average: TYM, Yanmar

- Less than 40% of the time on average: Kioti, New Holland, Case, LS Tractor, Bobcat

- Industry averages: 42% Tractor vs. 48% Powersport & 69% Automotive

-

“Phoned Customer” - How often did the brand’s dealerships respond by phone to a website customer’s inquiry?

- More than 30% of the time on average: Kubota, New Holland, John Deere

- Less than 15% of the time on average: LS Tractor, Case, Yanmar, McCormick Tractor

- Industry averages: 25% Tractor vs. 50% Powersport & 66% Automotive

-

“Did at least one” - How often did the brand’s dealerships email or text an answer to a website customer’s question and/or respond by phone?

- More than 60% of the time on average: TYM, Kubota

- Less than 50% of the time on average: Bobcat, LS Tractor, McCormick Tractor, Case

- Industry averages: 53% Tractor vs. 73% Powersport & 85% Automotive

-

“Did both” - How often did the brand’s dealerships email or text an answer to a website customer’s question and also phone the customer?

- More than 15% of the time on average: Kubota, John Deere, New Holland

- Less than 5% of the time on average: Kioti, Massey Ferguson, Bobcat, LS Tractor

- Industry averages: 13% Tractor vs. 26% Powersport & 49% Automotive

-

“Failed to Respond” - How often did the website customer fail to receive a response of any type (email, text, or phone call)?

- Less than 20% of the time on average: Kubota

- More than 30% of the time on average: McCormick Tractor, Kioti, Case, LS Tractor

- Industry averages: 27% Tractor vs. 9% Powersport & 6% Automotive

Missed Opportunities and the “80/40 Rule”

Each brand’s industry study ILE score is an average of their dealerships’ performances, each with scores ranging from 0-100. Industrywide, only 4% of compact tractor dealerships scored above 80 (providing a quick and thorough personal response), while 61% of dealerships scored below 40 (failing to personally respond to their website customers). In contrast, 40% of auto dealers currently score over 80, and 13% of powersports dealers score over 80.

“With an industry average score of 29, many tractor dealers’ web response behaviors leave a lot on the table, with nearly two thirds of dealers scoring under 40 in this year’s ILE study,” said O’Hagan. “The effort to improve is worth it. Historically, dealers who improve their ILE performance from scoring under 40 to scoring over 80 on average sell 50% more units from the same quantity of internet leads.”

About Pied Piper Management Company, LLC

Austin, Texas based Pied Piper combines artificial intelligence and trained human evaluators into the proprietary Prospect Satisfaction Index® (PSI®). PSI® measures how effectively each retail location follows proven sales and service best practices throughout a new customer's journey, from initial website inquiry or phone call, through follow-up, appointment setting, and the in-store experience.

Manufacturers, franchisors, dealer groups, and other organizations use PSI® reporting to drive dramatic improvement across their retail networks. What do they consistently say? "We just didn't know." PSI® reports act like a flashlight: revealing hidden issues in customer engagement that were quietly undermining performance.

“Today’s customers visit dealership websites first, and sales success is driven by how effectively dealerships respond,” said O’Hagan. “The challenge is that website customer experiences are often invisible or distorted by traditional dashboards, making this critical area of performance easy to overlook.”

For more than 15 years, Pied Piper has independently published annual industry studies that rank the omnichannel performance of brands and dealer groups. These studies track how industry performance changes over time and give current and prospective clients a benchmark to understand how their own performance compares.

Other recent Pied Piper PSI® industry studies include:

- 2025 Internet Lead Effectiveness® (ILE®) Auto Industry Study (Subaru ranked first)

- 2025 Service Telephone Effectiveness® (STE®) Auto Dealer Group Study (Group 1 ranked first)

- 2025 Service Website Effectiveness™ (SWE™) Auto Brand Study (Lexus ranked first)

- 2024 Telephone Lead Effectiveness™ (TLE™) Pontoon Boat Industry Study (BRP’s Sea-Doo brand ranked first)

Learn more, request a presentation of industry study results, or request ongoing PSI® measurement and reporting at www.piedpiperpsi.com.

This press release is provided for editorial use only, and information contained in this release may not be used for advertising or otherwise promoting brands mentioned in this release without specific, written permission from Pied Piper Management Co., LLC.

Contacts

Contact at Pied Piper:

Ryan Scott, rscott@piedpipermc.com, (831) 648-1075